The Form 13F for the first quarter of 2016 has been published, and the portfolios of hedge fund managers revealed.

In the disclosure, Mr George Soros’s Soros Fund Management appeared to have started positions in gold and a gold miner and also to have continued short selling of US stocks as he claimed in Davos in January 2016.

Continue reading George Soros buys gold and a gold miner, short sells S&P 500 →

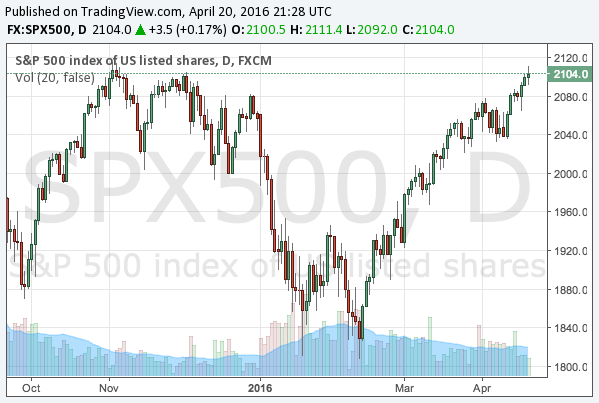

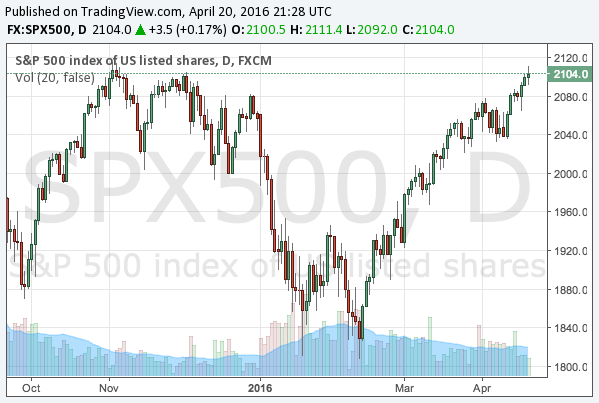

S&P 500 has recovered from the plunge in the beginning of 2016. Many famed hedge fund managers published their own view on the stock market, and who has been right so far? We would like to review the predictions by great investors such as George Soros, Ray Dalio and Bill Gross.

Continue reading Who was right about the US stocks in early 2016?: George Soros, Ray Dalio and Bill Gross →

The global deflation and low economic growth are the keys to investment in 2016. The weak demand from the decelerating Chinese economy has pushed down the commodity prices, and Europe and Japan are still struggling to recover from the recession.

Even the US economy has a symptom of a slowdown now, indicating it cannot support the rest of the world economy alone.

The advanced economies have already relied on the quantitative easing, and if even the QE cannot revive the economies, what would be the cause of such a strong deflationary force? Larry Summers, the former Treasury Secretary, called it secular stagnation.

Continue reading Hedge fund managers on secular stagnation: George Soros, Ray Dalio and Bill Gross →

The Form 13F for the third quarter is now available, so that now we can see the buy positions of famed hedge fund managers. This time, we review those of Mr George Soros and Mr John Paulson.

Mr Soros bets on China

One of the most interesting positions of Soros Fund Management would be his buying call options of iShares China Large-Cap ETF (NYSEARCA:FXI; Google Finance), which invests in large Chinese companies. Mr Soros bought the call options for the stocks of $140 millions, which means he bet on a quick rebound of Chinese stocks.

Continue reading Form 13F: George Soros buys Chinese stocks, the biggest bet common with John Paulson →

Throughout the last hundreds of years, the essence of the financial markets has never changed, and the investors repeatedly experience absurd financial bubbles of the common root.

This perhaps gives this article some significance, as we explain here the cause of Black Monday in 1987. Many say there was no specific reason of the market crash, or it is difficult to identify the cause, but some great investors indeed predicted the collapse in advance, as there were the definite causes of the bubble we can explain here.

Continue reading Why did Black Monday happen in 1987: Reaganomics, the Plaza Accord and the German rate hike →

Analysis and Practice in the Global Markets