In 2016, the Fed is trying to raise interest rates. The US economy is actually starting to decelerate, but the Core CPI (excluding food and enegies) is edging higher. If this uptrend is long-term, the Fed might be forced to rush for rate hikes undesirably.

Will that happen? Is the US economy going into stagnation? In this article we argue the outlook of inflation in the US and its influence on rate hikes, the stock markets and the gold price.

Continue reading The US inflation forecast 2016: the graph edges higher, implying stagflation →

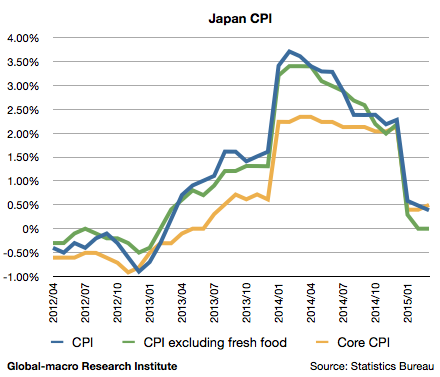

Did Abenomics successfully save Japan from deflation? Not really. Will quantitative easing and negative interest rates by the Bank of Japan (BoJ) make it better in the future? Not very likely.

The BoJ is no longer controlling the monetary policy of the Japanese economy. The central bank has already taken all the effective options, and thus the room for expansion of easing is quite limited. There is something that decides the monetary policy instead of the central bank.

Continue reading Explaining Japan’s deflation 2016: the cause is not just the consumption tax hike →

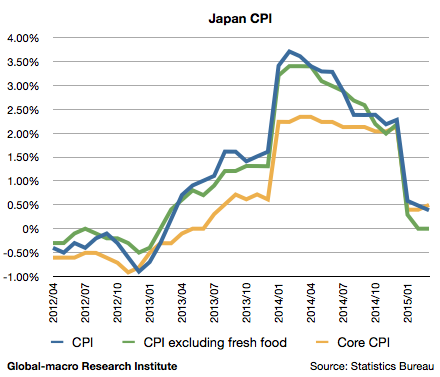

Since the Bank of Japan started the massive quantitative easing in early 2013 and then expanded it in late 2014, it’s remained silent on whether or not they’re planning more easing in the future.

Will they plan further easing? Our answer is yes, but there are a few possibilities for the timing. At the earliest it will be from Sep to Dec 2015, or at the latest it will be 2017. We shall discuss the data to explain why.

Continue reading 2015-2016: Bank of Japan’s monetary base and timeline for QE and its expansion →

Continue reading 2015-2016: Bank of Japan’s monetary base and timeline for QE and its expansion →

Analysis and Practice in the Global Markets