The eurozone’s economy is at the edge of collapse. Southern European countries experienced a sovereign debt crisis in 2010, and the unemployment rate in the euro area is still as high as nearly 10%. Italy rejected Mr Renzi’s pro-EU reform plan in the referendum, and in France, the anti-EU National Front’s Ms Le Pen is increasingly popular.

Yet what is the cause? Whilst the EU also faces the immigration crisis, the economic reason will be easily comprehended by only glancing at the trade statistics of the eurozone countries.

Continue reading The eurozone is a German colony, the net exports of the member states explain →

The US Bureau of Economic Analysis published the GDP data for the second quarter of 2016, and the real GDP growth turned out to be 1.23% (year-on-year), slowing down from 1.57% in the previous quarter. The US economy has been significantly slowing down in 2016 as we predicted last year, when it was growing more than 2%.

However, the published data this time suggests more detailed interpretation is necessary to predict the upcoming future of the US economy.

Continue reading The dollar to fall as the GDP growth in 2Q radically weakens, secular stagnation looms →

The dollar will fall, and the yen will strengthen in 2016. The Fed could not continue to raise rates, and the strong yen will be back again as the Bank of Japan’s monetary expansion is now limited.

There might be a number of investors who still bet on the yen’s fall due to Abenomics, but we recommend to reconsider. We even recommend to buy the currencies under quantitative easing, such as the yen or the euro. Here are the reasons.

Continue reading USD/JPY forecast in 2016: the BoJ’s expansion and the Fed’s rate hikes will both decelerate →

On the third of November, 2015, the ECB (European Central Bank) decided to cut interest rates and to extend its quantitative easing. Whilst we interpreted the market’s reaction in the following article, in this article we analyze how the increasing monetary base affects EUR/USD in a long term.

In this meeting, the deposit rate was lowered from -0.20% to -0.30%, and the QE programme was extended from September 2016 to March 2017. Thus, we first look into how the monetary base changes by the end of March 2017.

Continue reading How the ECB’s QE extension affects the euro: the QE timeline and the forecast of EUR/USD →

As the Fed remains unclear about when it raises interest rates, the investors are starting to doubt the Fed’s will for a rate hike. The doller is getting weak, and the gold price rebounded.

In the global markets, we also need to note that one central bank’s policy affects another central bank’s policy, and at the moment, this is the most true with the Fed and the Bank of Japan.

The Fed’s aim

As we explained in the following article, the Fed is not waiting for the further improvement of the labour market, but we estimate its aim is the depreciation of the stock market itself:

Continue reading USD/JPY: If the Fed postpones a rate hike, Japan’s QE expansion would also be delayed →

Our readers wouldn’t be surprised at the ongoing turmoil in the global stock markets as we’ve been warning about the decreasing liquidity and global economies’ slowdown:

However, we feel China’s currency devaluation increased investors’ worries further, so that the plunge became rapid and radical. For investors who’ve got concerned about their positions, we explain which trend in the markets is unchanged and what we can buy during the turmoil.

Continue reading Correction or crash?: Worldwide stock plunge, US rate hike, commodity market crash, Chinese yuan devaluation →

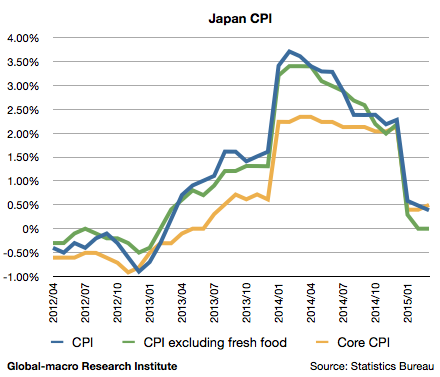

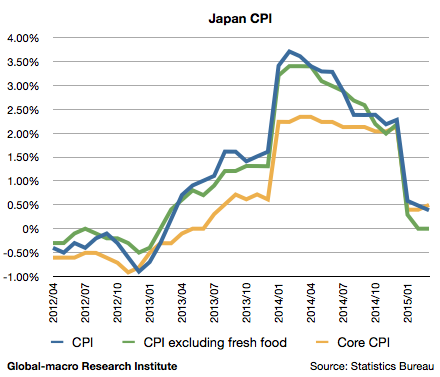

Since the Bank of Japan started the massive quantitative easing in early 2013 and then expanded it in late 2014, it’s remained silent on whether or not they’re planning more easing in the future.

Will they plan further easing? Our answer is yes, but there are a few possibilities for the timing. At the earliest it will be from Sep to Dec 2015, or at the latest it will be 2017. We shall discuss the data to explain why.

Continue reading 2015-2016: Bank of Japan’s monetary base and timeline for QE and its expansion →

Continue reading 2015-2016: Bank of Japan’s monetary base and timeline for QE and its expansion →

As the BoJ only claimed it would continue its quantitative easing until mid 2016, investors are now speculating whether the central bank extends the easing or not.

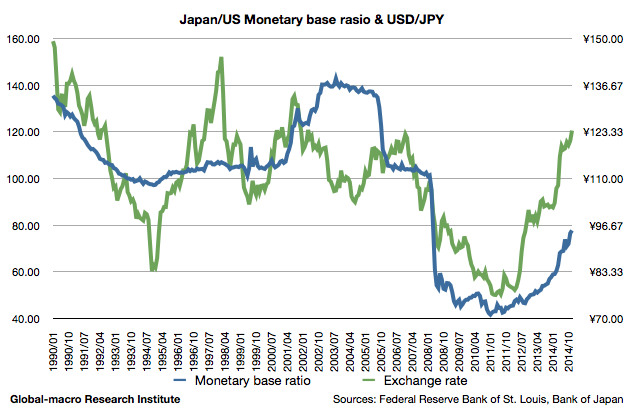

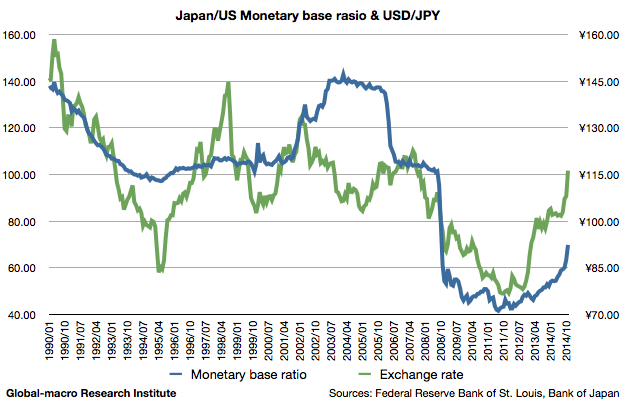

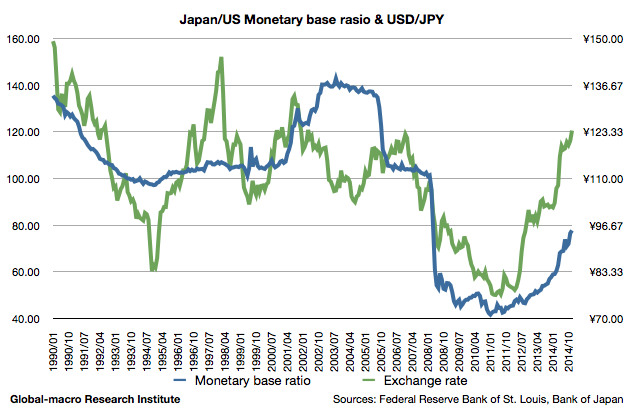

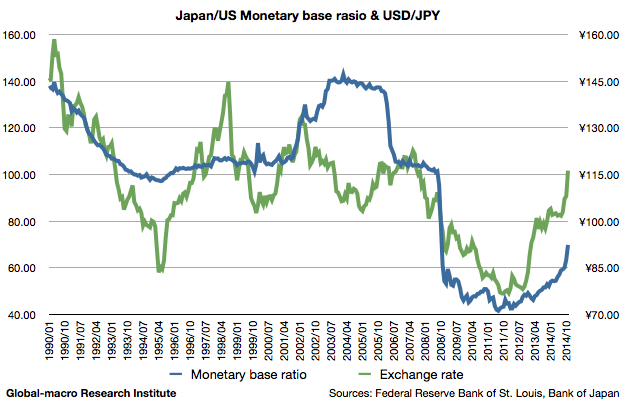

In this article, we discuss the impact of the QE extension/expansion to USD/JPY to clarify if the BoJ has an effective means to affect the currency market to support the inflation. We first review the chart of the monetary base ratio:

Continue reading 2015-2016: What will happen to USD/JPY when the BoJ expands the QE further? →

Continue reading 2015-2016: What will happen to USD/JPY when the BoJ expands the QE further? →

After the Bank of Japan (BoJ) decided the additional monetary easing on 31st of November, USD/JPY reached 122 once and is now traded around 120. We review if the rate is appropriate from a long-term viewpoint, after the radical depreciation from about 110.

Continue reading Is USD/JPY reasonable at 120?: The comparison of the manetary bases →

Continue reading Is USD/JPY reasonable at 120?: The comparison of the manetary bases →

Analysis and Practice in the Global Markets