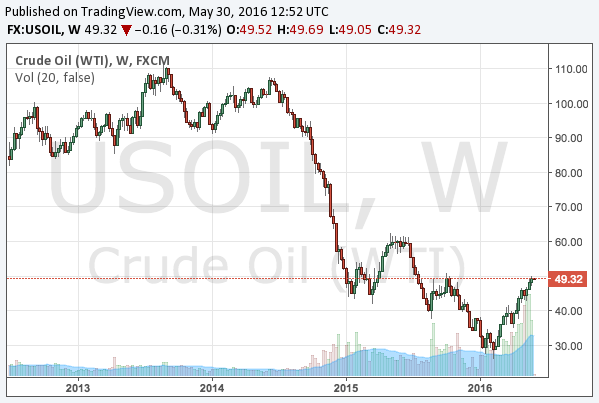

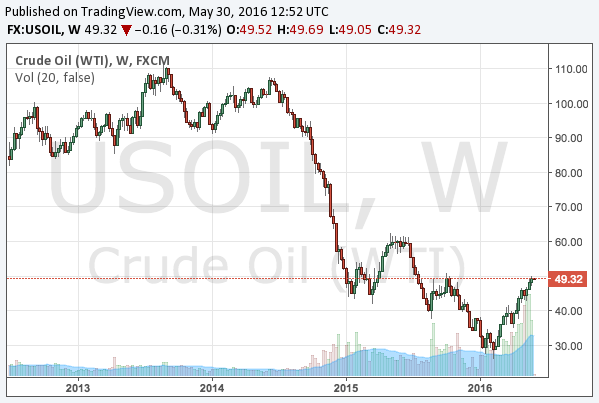

The earning releases of the US shale oil firms have been published in May 2016, whilst the oil price is rebounding from its bottom. The following is the chart of the WTI crude oil futures:

Then, how are the financial situations of the US shale oil industry? Would the financial results justify the recent rebound?

Continue reading The break-even point of the US shale oil industry and its production decline →

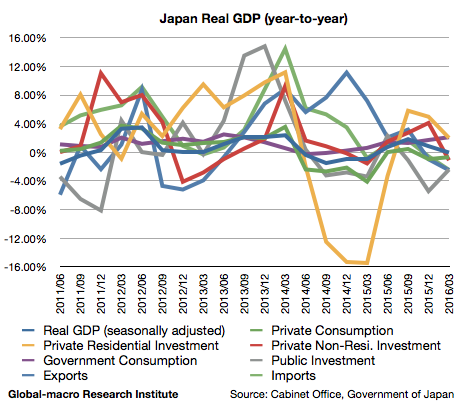

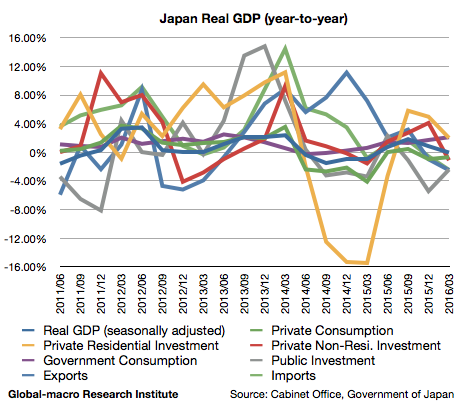

In the first quarter of 2016, Japan’s real GDP grew -0.05% (year-on-year), slowing down from 0.85% in the previous quarter. This is the first time since 2013 for Japan’s economy to grow negatively, excluding the four quarters after the consumption tax hike.

Continue reading 2016 1Q Japan’s GDP: the economy grew negatively due to the market turmoil →

Continue reading 2016 1Q Japan’s GDP: the economy grew negatively due to the market turmoil →

The Form 13F for the first quarter of 2016 has been published, and the portfolios of hedge fund managers revealed.

In the disclosure, Mr George Soros’s Soros Fund Management appeared to have started positions in gold and a gold miner and also to have continued short selling of US stocks as he claimed in Davos in January 2016.

Continue reading George Soros buys gold and a gold miner, short sells S&P 500 →

Since the first rate hike in Dec 2015, the Fed has been in the course of normalizing interest rates. Although we as well as many of the famed hedge fund managers expect the central bank will eventually cease raising rates and resume easing, it is still reasonable to assume one or two rate hikes in 2016 are still possible.

Even if it happens, rate cuts will follow it anyway, but it is important for investors to consider how to trade on the temporary monetary tightening. As federal funds rates futures expect only one rate hike in 2016, two rate hikes will be a surprise if it happens.

Continue reading 2016 US REIT forecast: the Fed’s rate hikes, rate cuts and quantitative easing →

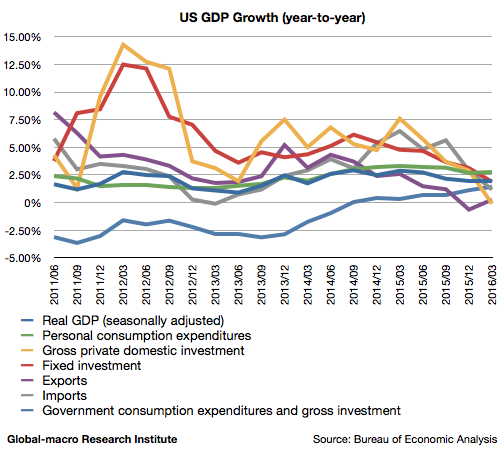

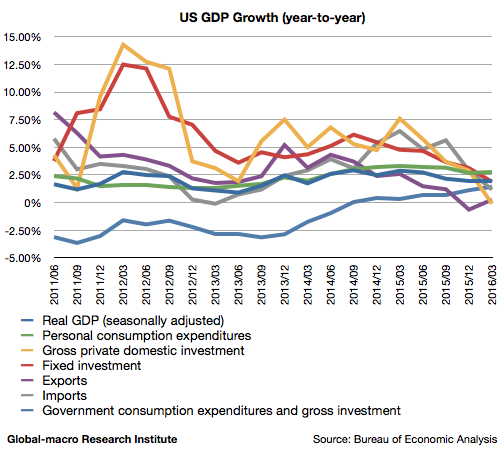

The GDP data of the US economy for the first quarter of 2016 is published, and the real GDP growth turned out to be 1.95% (year-on-year), slightly slowing down from 1.98% in the previous quarter.

As the economic growth in mid 2015 was greater than 2%, the figure indicates the economy has decelerated after the Fed ceased quantitative easing.

Continue reading 2016 1Q US GDP: the slowdown continues, justifying the weak dollar →

Analysis and Practice in the Global Markets