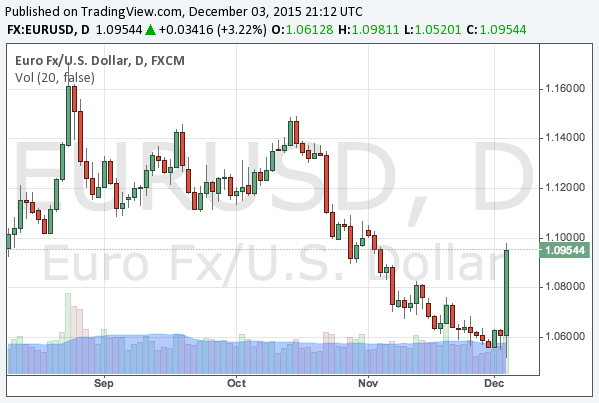

On the 3rd of December, the ECB (European Central Bank) decided to cut interest rates and extend its quantitative easing. The deposit rate was lowered from -0.20% to -0.30%, and it was declared that the central bank would maintain the QE until March of 2017, postponed from September of 2016.

As Dr Mario Dragi, the governor of the ECB, had suggested further easing in advance, some investors were expecting the expansion of the QE, which was not decided this time. Consequently, EUR/USD sharply rebounded.

Continue reading ECB cuts rates and extends the QE, the negative market reaction suggests the end of the QE bubble

Continue reading ECB cuts rates and extends the QE, the negative market reaction suggests the end of the QE bubble