The US stock market still remains at around the all-time high after the Fed started raising rates, and that is because investors believe, rationally or not, that the strong US economy will keep equity appreciated even without the support of the Fed. However, the US economy will slowdown, and then the stock market will lose its last resort.

Monthly Archives: December 2015

Crude oil price forecast 2016: the high yield bond crisis and bankruptcies in the shale oil industry

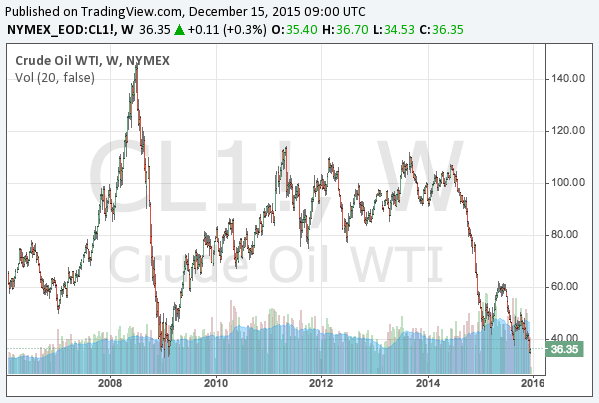

The crude oil price has fallen radically and is finding a comfortable level to be. Is it going down further? We presume it has to be, though we also suppose it will rebound eventually.

Then, how much further is it going down? When is it going to rebound? We provide answers to these questions in this article. The following is the long-term chart of the WTI crude oil futures:

Continue reading Crude oil price forecast 2016: the high yield bond crisis and bankruptcies in the shale oil industry

Continue reading Crude oil price forecast 2016: the high yield bond crisis and bankruptcies in the shale oil industry

2016 stock market forecast and stock option strategy: Crash or flat, that is the question

As the last article discussed the overall view of the financial markets in 2016, this article aims to specifically discuss the stock market.

We have insisted the easy market fuelled by the QE is already over, and the stock market will face difficulties and uncertainties. The following three remarks conclude our general forecast for the US stock market:

- The upside is limited due to rate hikes and the strong dollar

- A sudden plunge can always happen, presumably by 10-30%

- It still take a while till the total collapse of the QE bubble

In such a situation, mere buying or selling cannot be profitable. Both of short selling and the long-short strategy have some flaws. Then what can we do? After long contemplation, our conclusion is as below.

The financial markets in 2016: the forecast for stocks, bonds, currencies and commodities

The easy market for investors supported by the Fed’s quantitative easing is already over, and now the question is merely when, not if, the asset bubble bursts in several markets. The assets in a bubble are stocks, bonds and the dollar.

The Fed has ended its QE programme and is now in a process of raising interest rates. Will the US stock market be okay? It can never be okay as the central bank has injected trillions of money and is now going to retrieve it, but the market is manifesting groundless optimism.

The greatest premise investors believe in is the strong US economy and thus the strong dollar. However, the time is near for the uptrend of the dollar to be fading out. Why, how, and when? We will explain it in this article.

How the ECB’s QE extension affects the euro: the QE timeline and the forecast of EUR/USD

On the third of November, 2015, the ECB (European Central Bank) decided to cut interest rates and to extend its quantitative easing. Whilst we interpreted the market’s reaction in the following article, in this article we analyze how the increasing monetary base affects EUR/USD in a long term.

In this meeting, the deposit rate was lowered from -0.20% to -0.30%, and the QE programme was extended from September 2016 to March 2017. Thus, we first look into how the monetary base changes by the end of March 2017.

ECB cuts rates and extends the QE, the negative market reaction suggests the end of the QE bubble

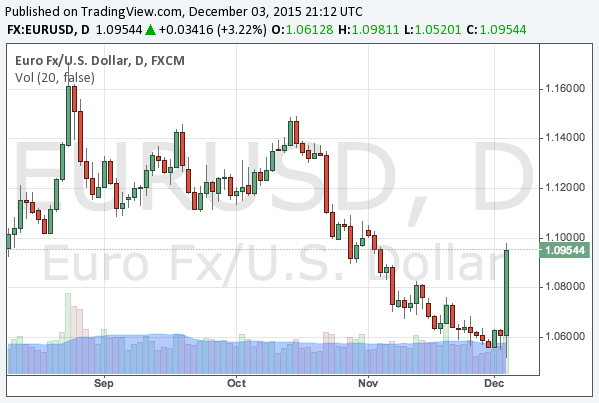

On the 3rd of December, the ECB (European Central Bank) decided to cut interest rates and extend its quantitative easing. The deposit rate was lowered from -0.20% to -0.30%, and it was declared that the central bank would maintain the QE until March of 2017, postponed from September of 2016.

As Dr Mario Dragi, the governor of the ECB, had suggested further easing in advance, some investors were expecting the expansion of the QE, which was not decided this time. Consequently, EUR/USD sharply rebounded.

Continue reading ECB cuts rates and extends the QE, the negative market reaction suggests the end of the QE bubble

Continue reading ECB cuts rates and extends the QE, the negative market reaction suggests the end of the QE bubble